Wages and Compensation

WAGES AND COMPENSATION

Contents

This module allows researchers to explore the features of minimum wage, public holiday pay, and vacation leave pay in employment standards across different jurisdictions. It also discusses the current political struggles to raise wage standards in the contexts under examination in the ESD, and examines how employees’ wage payment structure varies by jurisdiction and by employees’ social location. The module is organized around two key research questions:

- What are the central characteristics of minimum wage, public holiday pay, and annual vacation leave pay, and how do these features differ across the national and sub-national jurisdictions?

- How are the features of minimum wage, public holiday pay, and annual vacation leave pay related to employees’ social location (e.g., social relations of gender, race/ethnicity, migration status, age, (dis)ability), social context (i.e., occupation and industry), and job characteristics?

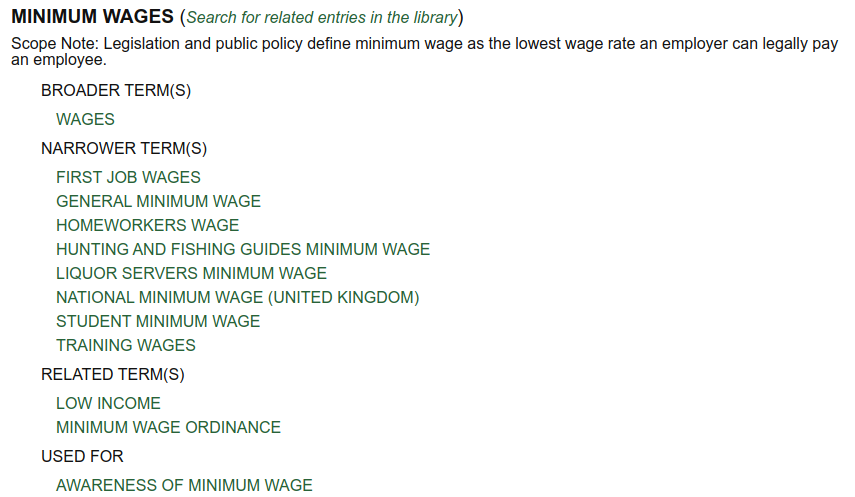

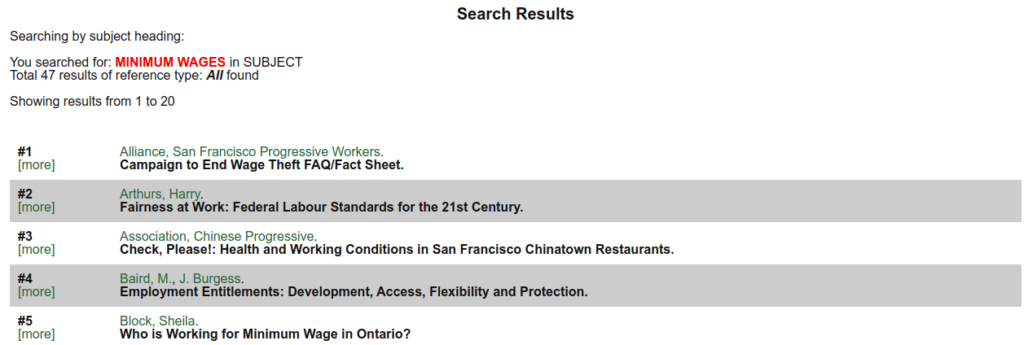

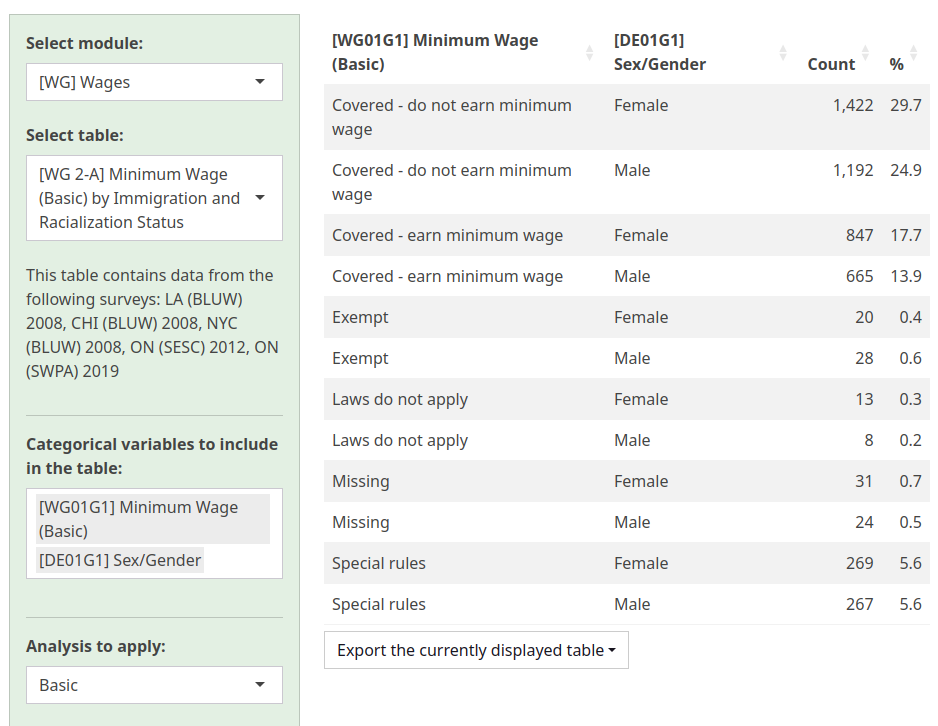

This module is comprised of an introduction to the ESD’s organizing themes and concepts surrounding wages and compensation and a description of the indicators devised on the basis of legislative details governing wages and compensation in the jurisdictions covered by the ESD. It also includes statistical tables incorporating survey data, a searchable library of published and unpublished papers, books and other resources, and a thesaurus of terms. These elements seek to provide a package of conceptual tools and guidelines for research.

KEY CONCEPTS

The wage package encompasses different components of remuneration for employees. It entails a basic rate of earnings typically paid by an employer to an employee on the basis of time: hourly, daily, weekly, monthly, or yearly (usually deemed wages for hourly and daily periods, and deemed salary for monthly and yearly periods). It also includes a bundle of elements beyond the basic rate of earnings that significantly shapes the living standards of individuals and households (Vosko, 2006). Such elements include vacation pay and public holiday pay (which will be discussed in detail below), as well as sick leave pay and termination and severance pay, among others. Additional types of benefits including those related to unemployment, pension, workplace accident, or health insurance may also be considered components of the wage package (Clarke, de Gijsel, & Janssen, 2000).

MINIMUM WAGE

Minimum wage is the minimum amount of money an employer may pay an employee. It is intended to set a floor for wages in a given jurisdiction, to redistribute earnings to low-wage employees, and to establish and protect the lower tiers of the labour market from erosion (Freeman, 1996, p. 639). It is an expression of employment standards’ role in establishing social minima in employment (Vosko, Noack, & Thomas, 2016).

In many countries, including all those that comprise the ESD, such as Canada, the United States and the United Kingdom, the earliest regulations pertaining to the minimum wage were deeply gendered. In Australia, by the turn of the 1900s, many early wage regulations were formulated to respond to the prevalence of exploitative working conditions among women. Federal and State governments established bodies that set minimum wage rates, and women’s minimum wage rates were typically set at rates at least 50 percent below men’s (McCallum, 1986, p. 30; Vosko, 2010, p. 32).

In the early 1900s, Britain began to regulate minimum wages in response to concerns about ‘sweated labour’, moral fears about prostitution, eugenicist fears over the health of the English race, and suggestions that low-priced labour could hinder economic progress (Vosko, 2010). Minimum wages were introduced in industries that were predominantly female, and where exploitative conditions were common (McCallum, 1986, p. 30). Specifically, in 1909 Britain passed the first Trades Boards Act, which created wage-setting protocals for application in such industries as tailoring, paper and cardboard box making, chain making, and lace mending and finishing (Lewis & Rose, 1995, p. 115).

The earliest American minimum wage laws at the state level covered only women and children. The restricted coverage of state minimum wage laws was intended to avoid violating the protection of freedom of contract clause of the US Constitution. Nevertheless, several constitutional challenges followed, and in 1923, the Federal Supreme Court declared the minimum wage law of D.C. to be unconstitutional. In addition, the enforcement of state minimum wage laws was weakened as officials tended to weigh the health of women workers against the health of industry in general and employers’ capacity to pay adequate wages (Levin-Waldman, 2001, p. 54; Vosko, 2010). In the United States, in 1938, a federal minimum wage was established under the Fair Labour Standards Act, which remains in place today.

In Canada, in 1900, the federal government issued a policy to “ensure the payment of ‘fair wages’ to persons employed on all public works and government contracts” (Vosko, 2010, p. 34). By the early 1920s, most provinces had legislation establishing minimum wage boards that set wage rates for female wage earners on an industry by industry basis after consultation with representative employers and employees with exemptions for domestics, farm employees, and others (Vosko, 2010; see also McCallum, 1986).

These laws would eventually be supplanted by stronger provincial and territorial, as well as federal, employment standards legislation setting out minimum wages as well as employment standards relating to working time, leaves, termination and severance of employment etc. However, employment standards legislation has never been inclusive of everyone engaged in work for pay or remuneration. That is, self-employed workers with employees have largely been excluded, as well as many self-employed workers without employees – with the exception, in certain jurisdictions, of those that are misclassified or defined as dependent contractors. Coinciding with such exclusions, in many jurisdictions in Canada numerous exemptions and special rules apply to occupational and industrial groups as well as to workers engaged in different forms of employment – including exemptions and special rules related to minimum wages (on the Ontario case, see for example, Vosko, Noack, & Thomas, 2016).

Tips: Tips are payments that are voluntarily paid by a customer to an employee (or employees) or to an employer for an employee (or employees). The requirement to pay tips may also be imposed by the employer. For many employees in the service industry, such as restaurant servers or liquor servers, tips can comprise a substantial share of their income. Employment standards can recognize the provision of tips by establishing lower minimum wages for tipped employees.

Tips are associated with certain forms of employment insecurity. As a form of remuneration, tips rely on the presence of customers, and are paid at the discretion of the customer. Tips also involve customers in the employing activity, while the legal employment relationship remains between the employee and the employer (Albin, 2011; Matulewicz, 2015). Studies demonstrate how, in service industries especially, the practice of tipping fuels a situation in which employees are under pressure to adopt certain forms of emotional labour or appearance to meet the expectations of customers, a gendered process that can fuel the sexual harassment of employees (Matulewicz, 2015).

Exemptions, Special Rules and Deductions: In numerous jurisdictions, including Ontario and the US, minimum wage regulations are subject to certain exemptions and special rules that limit their application. For example, in Ontario, farm employees are not entitled to the minimum wage. As of 2019, therefore, liquor servers earned $12.20 per hour while the general minimum wage is $14.00 per hour. In the US, “executive, administrative, or professional” employees are exempt from the minimum wage even though employees in this these categories may earn low wages.

In most jurisdictions, employer deductions from wages are permissible under certain conditions. Such conditions include if the deduction is authorized in law for reasons such as paying an unemployment Insurance premium or public pension contributions; if a deduction is authorized by the employee for their own benefit; or to comply with a court ordered garnishment.

Political Struggles to Raise Wages: In the face of deepening concern over economic inequality as well as the spread of low-wage work, struggles over minimum wage have become more prominent in the past decade. For example, the ‘Fight for $15’ campaign grew out of a labour action among fast food employees in New York in 2012, and has since spread to many countries to target minimum wage legislation specifically. It achieved some limited victories in Canada, as well as in various jurisdictions in the US including New York State, California, and many cities. Preceding the ‘Fight for $15’ Campaign, the Living Wage Movement emerged in the United States in the 1990s in protest against stagnating incomes, and the spread of low-wage work in service industries (Evans & Fanelli, 2016). Living Wage advocates, encompassing a diverse group of labour activists, faith-based groups, and community organizations, often target municipalities, and seek the passage of ordinances that either mandate living wages for municipal contractors and/or that establish a living wage for all employees in the municipality. Living Wage advocates also call for employers to voluntarily adopt a living wage. In contrast with a legislated minimum wage, a living wage is determined in relation to the costs of living in a given jurisdiction, and it emphasizes economic need (Evans & Fanelli, 2016).

PUBLIC HOLIDAY PAY AND ANNUAL VACATION LEAVE PAY

Public holiday pay is the remuneration employees receive for public holidays on which they do not work. It may also refer to the premium pay employees may receive that is in addition to their basic rate of earnings if they do work on a public holiday.

Annual vacation leave pay is the remuneration that accompanies an annual vacation leave entitlement. In jurisdictions where vacation pay is legally mandated, vacation pay is typically calculated as a percentage of employees’ yearly earnings and is paid out each pay period, or as regular pay during the vacation period.

Annual vacation leave pay and public holiday pay are components of the wage package that are closely tied to public holiday and vacation leave provisions explored in the module on leaves.

Article 24 of the Universal Declaration of Human Rights states that “Everyone has the right to rest and leisure, including ….periodic holidays with pay” (United Nations, 1948). Nevertheless, access to public holiday pay and annual vacation leave pay varies across jurisdictions. There is no law mandating such pay in the UK or in the US. While holiday pay or vacation pay may be included in individual employment contracts, they are much less common among low-wage employees, among employees of small businesses, and for part-time employees (Ray, Sanes, & Schmitt, 2013). In other jurisdictions where holiday pay and vacation leave pay are mandatory, exemptions and special rules may limit certain employees’ entitlement to these standards.

INDICATORS

Wage and wage compensation indicators can be grouped into three major domains: “Wage Package,” “Payment Structure,” and “Deductions.” The purpose of these measures is to identify the degree to which survey respondents are entitled to minimum wage coverage, public holiday pay, and vacation pay given their occupation and workplace. Overall, these indicators can help us understand the employment standards related to wage compensation policies and regulation across different jurisdictions in Canada, the US, the UK, and Australia in three ways.

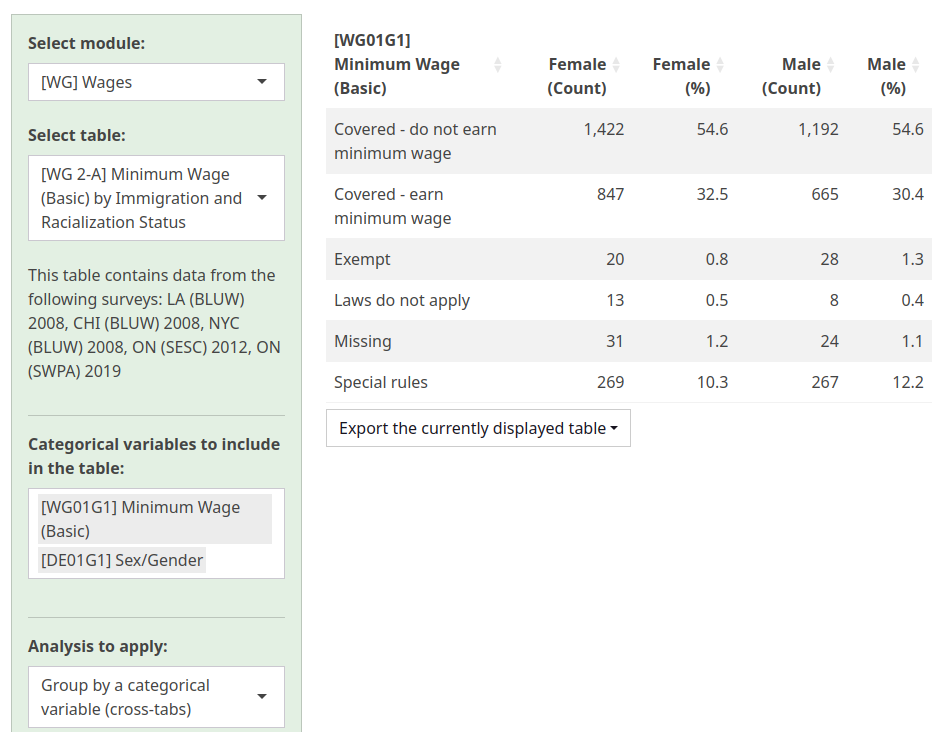

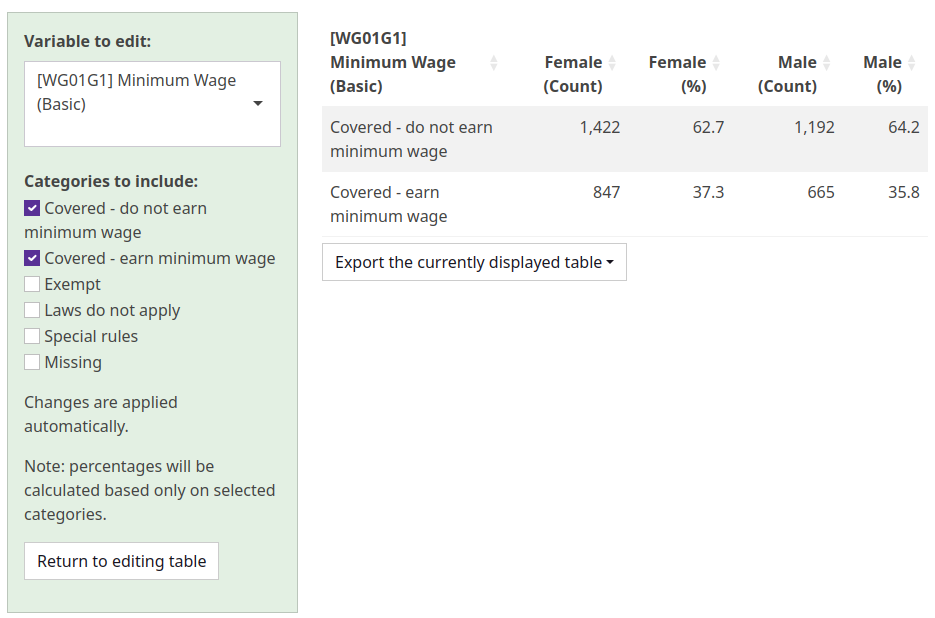

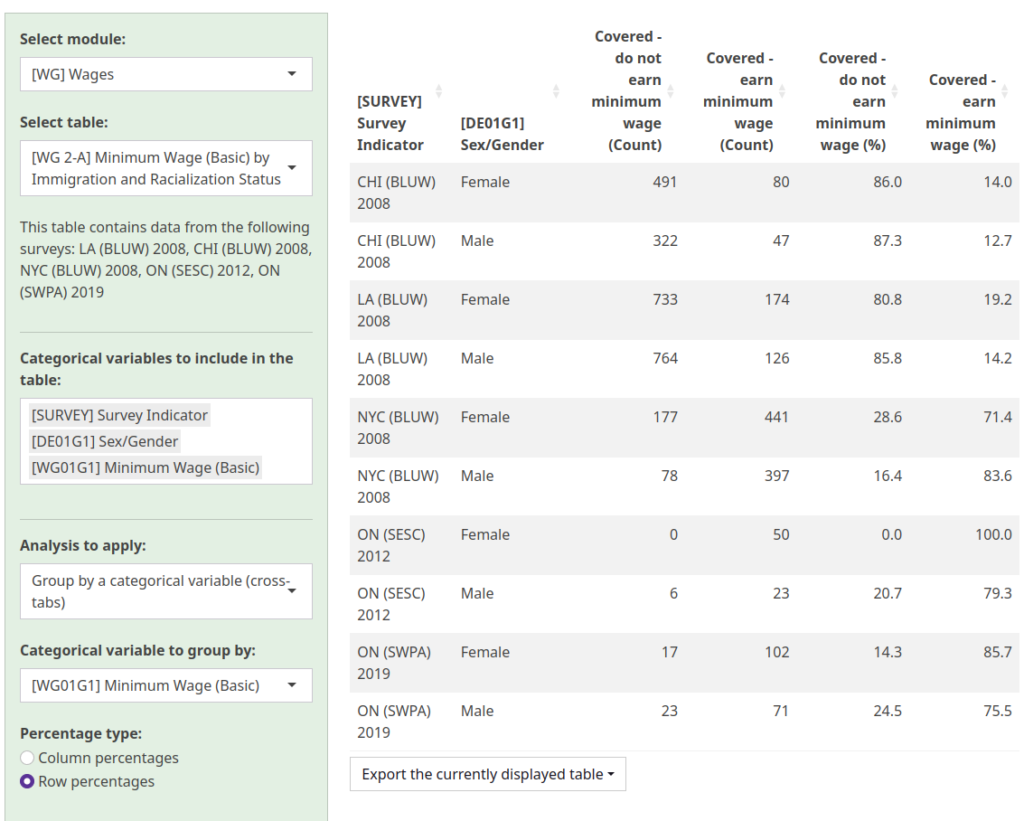

First, ten variables provide information on the wage package. Three variables measure the perception and awareness of minimum wage and if people are actually receiving the minimum wage (WG1G1, WG1G2, WG1G3).The first measures if a person’s hourly rate of pay in their main job is above the jurisdictional minimum wage. The second examines respondents’ awareness of minimum wages that apply to their work. Finally, the third uses hourly wages as a proxy to calculate if respondents earn the minimum wage in their respective jurisdiction at the time of the survey. Another three variables capture the entitlement and access to public holiday and vacation pay (WG2G1, WG3G1, WG3G2). Tips and commissions may be considered as part of one’s wages. The following harmonized variables measure if respondents earn tips and commissions and if so, how much they earn (WG4G1, WG5G1-WG5G5).

Second, eleven variables focus on the measures of payment structure, including mode, manner and frequency of pay, and the rate of pay (WG6G1-WG6G3, WG7G1-WG7G4, WG8G1-WG8G4). There are three variables that examine the mode, manner, and frequency of pay. Mode of payment includes hourly, contract, salary, and piece payment. Manner of payment includes cash payment, no cash payment, or combination of cash and no cash. Finally, frequency of payment indicates if employees are paid daily or otherwise (non-daily), which includes employees paid weekly, bi-weekly, monthly, or yearly. Rate of pay and wages broadly refers to the different ways of measuring how people are paid. The database has three variables relating to rate of pay: hourly rate of pay in main job in Canadian currency; hourly rate of pay in main job adjusted to inflation in national currency; and, hourly rate of pay in main job adjusted to inflation in Canadian currency.

Third, three variables capture wage deductions (WG9G1-WG9G3). The theme of deductions aims to analyze the experience and awareness of different deductions from employees’ wages or pay; mainly in the form of state deductions and employer deductions. Several variables capture wage deductions, including hourly wage and salary before deductions in main job (in Canadian, national, and inflation adjusted currencies), whether respondents have experienced state deductions or employer deductions, and unallowable employer deductions.

Detailed information on regulations in different jurisdictions in this module provides guidance for understanding the national contexts of employment standards related to wage payment compensation, minimum wage, public holiday pay, annual vacation leave pay, and deductions.

JURISDICTIONAL MAPPING INFORMATION

MINIMUM WAGE

CANADA

Scope: Employment standards in the federal jurisdiction in Canada are regulated under Part III of the Canada Labour Code (CLC). The CLC applies only where an employment relationship exists; independent contractors are not considered employees and therefore the CLC does not apply to them. The CLC applies to full-time, part-time, and casual employees.

Federally regulated sectors include interprovincial and international services such as:

- railways;

- road transport;

- telephone, telegraph, and cable systems;

- pipelines;

- canals;

- ferries, tunnels, and bridges;

- shipping and shipping services;

- radio and television broadcasting, including cablevision;

- air transport, aircraft operations, and aerodromes;

- banks;

- undertakings for the protection and preservation of fisheries as a natural resource; and

- some First Nations communities and activities.

Undertakings declared by Parliament to be for the general advantage of Canada, such as:

- most grain elevators;

- flour and seed mills, feed warehouses, and grain-seed cleaning plants; and

- uranium mining and processing, and atomic energy.

Most federal Crown corporations, such as the Canada Mortgage and Housing Corporation and the Canada Post Corporation, are also covered by the CLC’s labour standards. Federal public service employees are not covered; instead their terms of employment are regulated through the Federal Public Sector Labour Relations and Employment Act and the Public Service Employment Act.

Basic Standard: In 2021, the Canadian government reintroduced a minimum wage covering employees in federally-regulated industries. Prior to this reform, federally-regulated employees earned the general adult minimum wage of the province and territory in which they performed the majority of their work. The federal minimum wage is indexed to inflation using the national Consumer Price Index (CPI) and adjusted annually. As of April 2023, the federal minimum wage is $16.65 per hour.

Special Situations

Three-Hour Requirement: If an employee is called to work, they must be paid for at least three hours of work at their regular wage rate, whether or not the employee is asked to do any work after so reporting.

Deductions: When room and/or board are provided by an employer and the arrangement is accepted by the employee, the employee’s wages may be reduced below the minimum wage, but not by more than 50 cents per meal and 60 cents per day for lodging. An employer may not make deductions from wages or other amounts due to an employee unless the deduction is required by federal or provincial law (such as taxes and employment insurance premiums); is authorized by a court order or collective agreement; or is related to specified amounts authorized in writing by an employee or the overpayment of wages by the employer. An employer may not make deductions for damage to property or loss of money or property if any person other than the employee had access to the property or money in question.

ONTARIO

Scope: Self-employed workers are entirely exempt from Ontario’s Employment Standards Act (ESA). Even among those deemed employees, workers in certain occupations or with certain characteristics are exempt from the ESA, and therefore from its minimum wage provisions. Employee categories to who the ESA does not apply include:

- employees of employers that fall under federal employment law jurisdiction, such as airlines, banks, the federal civil service, post offices, radio and television stations, and inter-provincial railways;

- people performing work under a program approved by a college of applied arts and technology or university;

- secondary school students who perform work under a program authorized by the school board that operates the school in which the student is enrolled;

- people who do community participation under the Ontario Works Act, 1997;

- police officers (except for the Lie Detectors part of the ESA, which does apply);

- inmates taking part in work or rehabilitation programs, or young offenders who perform work as part of a sentence or order of a court; and

- people who hold political, judicial, religious, or elected trade union offices.

There are also some employees who are covered by the ESA generally but who are exempted from certain parts of it. The regulations of the ESA set out multiple occupations and types of employees who are exempt from some aspects of the ESA but covered by others, and to whom Special Rules apply for yet other aspects. For example, construction employees are covered by regulations regarding minimum wage, eating periods, overtime, and vacation with pay, but are exempt from regulations regarding hours of work, daily rest periods, time off between shifts, weekly/ bi-weekly rest periods, notice of termination/termination pay, and severance pay, while a special rule applies to them for public holidays.

Basic Standard: Ontario has legislated minimum wages since the 1920s (McCallum, 1986). Since 2000, minimum wages in Ontario have been regulated under the Employment Standards Act (ESA) (2000). Minimum wage rates are indexed to the rate of inflation and, in principle, can change annually. The minimum wage increased from $10.25 in March 2010, to $11.00 in June 2014, to $11.25 in October 2015, and to $11.40 in October 2016, making for an increase of only $1.15 over a 6 year period. (Or from $8 in February 2007 to $11.40 in February 2017, making for an increase of $3.40 over a decade) As of October 2023, Ontario’s minimum wage is $16.55 per hour.

The ESA defines wages to include any allowances for room or board agreed to under a contract, but not to include tips and other gratuities, gifts or bonuses given at the employer’s discretion, expenses and travelling allowances, and employer contributions to a benefit plan. Compliance with the minimum wage requirements is determined on a pay period basis.

Although tips are not included in minimum wage calculations, the minimum wage is lower for liquor servers, as a group of employees regularly expected to receive tips. The ESA did not originally contain rules pertaining to tips, but was amended to do so by the Protecting Employees’ Tips Act, 2015, which came into force in June 2016.

According to the Ministry of Labour’s guide to the ESA, most employees are eligible for minimum wage, whether they are full-time, part-time, casual employees, or are paid an hourly rate, commission, piece rate, flat rate, or salary.

If an employee’s pay is based completely or partly on commission, it must amount to at least the minimum wage for each hour the employee has worked. Some industry-specific and job-specific exemptions and special rules may also apply to salespeople who earn commission.

Special Situations

Three-Hour Requirement: When an employee who regularly works more than three hours a day is required to report to work but works less than three hours, he or she must be paid the highest of either three hours at the minimum wage, or his or her regular wage for the time worked. This rule does not apply to students (including students over 18 years of age), employees whose regular shift is three hours or less, and in some cases where the cause of the employee not being able to work at least three hours was beyond the employer’s control.

Deductions: Only three kinds of deductions can be made from an employee’s wages:

i) Statutory Deductions: Certain statutes require an employer to withhold or make deductions from an employee’s wages, for example, for income taxes, employment insurance premiums, and Canada Pension Plan contributions. An employer is not permitted to deduct more than the applicable statute allows and cannot make deductions if the money is not remitted to the proper authority.

ii) Court Orders: A court order may indicate that an employee owes money either to the employer or to someone else other than his or her employer, and that the employer can make a deduction from the employee’s wages to pay what is owed. The Wages Act limits how much the employer is allowed to deduct at any one time.

iii) Written Authorization: An employer may also deduct money from an employee’s wages if the employee has signed a written statement authorizing the deduction. This “written authorization” must state that the employer may make a deduction from the employee’s wages, and specify the amount of money to be deducted or provide a method of calculating the specific amount of money to be deducted.

Even with a signed authorization, an employer cannot make a deduction from wages if the purpose is to cover a loss due to “faulty work” or the employer has a cash shortage or has had property lost or stolen when an employee did not have sole access and total control over the cash or property that is lost or stolen.

An employer can take into account the provision of room and board (meals) in calculating whether the minimum wage has been paid to an employee. (Room and board is only deemed to have been paid as wages if the employee has received the meals and occupied the room.) The ESA specifies in some detail (depending on whether room is private or non-private, per meal up to a weekly maximum) the amounts the employer can claim as wages for room and board provided. Employers are not allowed to include the cost of the room as part of the wage for domestic employees, but they are allowed to claim the weekly maximum on meals for domestic employees. Room rates for serviced and un-serviced rooms are also specified for harvest employees who typically live seasonally on or close to the employer’s premises.

Exemptions: Among Ontario employment standards, the minimum wage is one of the most widely applicable standards. Almost nine out of ten Ontario employees are fully covered by the minimum wage provisions of the ESA. But almost 400,000 employees (8%) are exempt from minimum wage provisions.

Farm employees, residential care employees as well as residential building supervisors, janitors, and caretakers are all exempt from minimum wage standards. The details of these exemptions can be found on the Ontario Ministry of Labour Employment Standards website.

Special Rules: The minimum wage varies from the general minimum wage for the following categories of employees.

Table 1: Special Minimum Wage Rates in Ontario

| Minimum Wage Rate | Rates as of October 2023 |

| Student Minimum Wage | $15.60 per hour |

| Hunting and Fishing Guides Minimum Wage | $82.85 Rate for working less than five consecutive hours in a day $165.75 Rate for working five or more hours in a day whether or not the hours are consecutive |

| Homeworkers Minimum Wage | $18.20 per hour |

The student minimum wage applies to students under the age of 18 who work 28 hours a week or less when school is in session, or work during a school break or summer holidays.

The hunting and fishing guides minimum wage is based on blocks of time instead of by the hour. They get a minimum amount for working less than five consecutive hours in a day, and a different amount for working five hours or more in a day – whether or not the hours are consecutive.

The homeworkers minimum wage applies to employees who do paid work in their own homes, and is higher than the general minimum wage in order to compensate for this. For example, they may sew clothes for a clothing manufacturer, answer telephone calls for a call centre, or write software for a high-tech company. Students of any age (including students under the age of 18 years) who are employed as home employees must be paid the homeworker’s minimum wage.

A special rule applies to minimum wages for harvesting employees. This rule specifies that if employees are paid on a piece work basis, the employer is considered to be in compliance with the minimum wage requirement, even if a particular employee earns less than the minimum wage, as long as the piece work rate is customarily and generally recognized in the area where the work is being done as being high enough that an employee using reasonable effort could earn at least the minimum wage.

A special rule also applies to minimum wages for personal support employees: they are entitled to be paid the minimum wage for no more than 12 hours a day even if they work longer.

UNITED KINGDOM

Scope: In the United Kingdom, there is a National Minimum Wage and a National Living Wage. The National Minimum Wage Act 1998 first took effect in 1999 (Metcalf, 2008). This piece of legislation implements the National Minimum Wage and provides powers to the Low Pay Commission to review minimum wage rates annually. On April 1 2016, this Act was amended to introduce the National Living Wage, which significantly elevated the minimum wage rate for employees aged 25 and older. The National Living Wage only applies to employees aged 25 or older. It is higher than the National Minimum Wage.

The National Minimum Wage is the minimum pay per hour employees in the UK over school leaving age are entitled to by law (school leaving age is determined to be the last Friday in June of the school year that a person turns 16; Sargeant, 2010). This rate depends on a worker’s age and whether or not they are an apprentice.

Basic Standard: Both the National Minimum Wage and the National Living Wage are reviewed annually by the Low Pay Commission and new rates come into effect on the first of April each year. As of April 2023, the National Living Wage is set at £10.42 per hour. The National Minimum Wage and National Living Wage as of April 2023 are set out in Table 2.

Table 2: Basic Minimum Wage by Main Distinctions, United Kingdom, as of April 2023.

| 23 years and older | £10.42 |

| 21 to 22 years old | £10.18 |

| 18 to 20 years old | £7.45 |

| 16 to 17 years old | £5.28 |

| Apprentices under 19, or those 19 and over in their first year of an apprenticeship | £5.28 |

The National Minimum Wage and National Living Wage are measured as hourly rates. All eligible employees are entitled to the minimum wage even if they are not paid by the hour. Where work is measured by piece work, annual salary, or as unmeasured forms of work (for example, painting a house) instead of by the hour, formulas are used to calculate fair wage rates that are equivalent to the hourly rate.

Special Situations

Deductions: There are three conditions that must be met in order for wage deductions to be made:

- deductions must be required by law (for example, income tax);

- the terms must be authorized by the employment contract and the worker must have received a written copy of these terms before the deductions are made; and/or

- the worker must have consented to these terms in writing before the deductions are made.

One exemption to these conditions is if an employer needs to retrieve an earlier overpayment of wages or expenses made to a worker. In the case of retail employees, there are additional protections in place. Apart from final payments made on termination of employment, it is illegal for an employer to deduct more than 10 percent of a employees’ wages if the deduction relates to cash shortages or stock deficiencies.

Accommodations provided by an employer can be deducted from the National Minimum Wage or National Living Wage; however, no other forms of company benefits can be applied against the minimum wage. If an employer charges more than the offset rate for an accommodation the difference can be taken off the worker’s wages (including the National Minimum Wage or National Living Wage). If the accommodation is at or below the offset rate, then the worker’s wages are not impacted. When accommodations are provided free of charge, the offset rate is added to the worker’s wages. Table 3 shows the accommodation offset rates, as of January 2023.

Table 3: Accommodation Offset Rates, as of January 2023

| Daily accommodation offset rate | Weekly accommodation offset rate |

| £8.70 | £60.90 |

Exemptions: There are several exemptions to the National Minimum Wage and National Living Wage. Those not entitled to the National Minimum Wage or National Living Wage include:

- Self-employed people

- Volunteers or voluntary employees

- Company directors

- Employees on a government employment program, such as the Work Programme

- Employees on a Job Centre Plus Work trial for up to 6 weeks

- Employees younger than school leaving age

- Students on a work placement up to one year, student internships or job shadowing family members, or people who live in the family home of the employer who undertake household tasks

- Members of the armed forces

- Employees in government pre-apprenticeship schemes

- Shore fishermen

- Prisoners

- People living and working in a religious community

- People in the following EU programmes: Leonardo da Vinci, Youth in Action, Erasmus, or Comenius

Generally all other employees must receive at least the National Minimum Wage, including disabled employees, foreign employees, offshore employees, agricultural employees, piece employees, home employees, trainees and employees on probation, agency employees, commission employees, part-time employees, and casual labourers.

Special Rules: Prior to October 1, 2013, the Agricultural Wages Order set out the agricultural minimum wage for every worker employed in the agricultural sector in England and Wales. Agricultural employees in England and Wales who were employed prior to October 1, 2013 are entitled to the same terms and conditions of their employment contract. Agricultural employees in England and Wales employed after October 1, 2013 are entitled to the appropriate minimum rate of pay (NMW or NLW). Employees in Wales must be paid either the agricultural minimum wage or the national minimum wage, whichever is higher of the two.

The Scottish Agricultural Wages Board (SAWB) sets the minimum pay rates, as well as holiday and sick pay entitlements for agricultural employees in Scotland. Agricultural Wages Order No. 66 for Scotland now aligns the minimum wage for agricultural workers with the UK National Living Wage of £10.42 as of April 2023.

AUSTRALIA

Scope: The Fair Work Act of 2009 governs the majority of workplaces in Australia. It outlines Australia’s National Employment Standards, which are a series of 10 minimum standards of employment that must be provided to all national workplace relations system employees. Although some state-level legislation exists, together, the national minimum wage and the National Employment Standards form the basic entitlements for the majority of employees in Australia.

Basic Standard: Australia’s national minimum wage applies to adults aged 21 years and older. The current national minimum wage is outlined in Table 4.

Table 4: Australia’s National Minimum Wage (as of July 1, 2023)

| Hourly Minimum | $23.23 |

| Weekly Minimum | $882.80 |

It is the role of Australia’s Fair Work Commission to review the national minimum wage, create modern awards, and approve enterprise agreements. The national minimum wage and pay rates for all awards are reviewed on an annual basis. Any changes come into effect on July 1 of the following year.

Most jobs in Australia are covered by a modern award. These set the pay rates for specific types of work or work within a specific industry. A modern award’s pay rate can never be less than the minimum wage. In addition, many businesses in Australia also have an enterprise agreement. If an enterprise agreement applies to an employee, it replaces any modern award that would otherwise apply to them. However, the pay rate in an enterprise agreement can never be lower than the modern award or the national minimum wage. No employment contract, whether verbal or written, can be less than what they would receive under an applicable enterprise agreement, modern award, or the national minimum wage.

Each award specifies the minimum rates of pay for work in each employee group that the award covers. Pay guides for each award also specify these minimum rates for each employee group based on their level of experience. For instance, the Hair and Beauty Industry Award covers employers and employees who work in the hair and beauty industry. The positions covered by this award include barbers, stylists, make-up artists, and nail technicians, among others. For a hair and beauty employee, there are different rates of pay depending on their level of experience (ranging from a recent graduate, to levels one through six).

The minimum wage is measured as an hourly or weekly pay rate; however, under certain conditions employees may instead by paid according to piece rates, commission payments, or annualized salaries. An agreed to annual salary cannot be less than the equivalent entitlements under the minimum wage or any applicable award or enterprise agreement. The National Minimum Wage Order also sets out a rate for casual loading (a premium to account for employment defined by dimensions of labour market insecurity, such as high levels of uncertainty, paid in lieu of benefits otherwise attached to the wage package); as of July 1, 2023 the casual loading rate is 25 per cent.

Special Situations

Deductions: There are three conditions that must be met in order for wage deductions to be made:

- deductions must be required by law, by a court order or by the Fair Wage Commission (for example, payments into an employee’s super fund);

- deductions must be allowed under the employee’s award or a registered agreement; or

- the employee must agree to the deductions in writing.

One exception to these conditions occurs in the case where an award contains a clause that allows pay deductions without employee consent. In this case, the deductions may be made. Deductions are not allowed if the employee is under the age of 18 and their parent or guardian has not consented in writing to the deductions, even when it is in accordance with an award. All deductions must appear on an employee’s pay slip and wages records. Employers are allowed to make deductions when they need to retrieve overpayment of wages due to a payroll error, provided the employer and employee have come to a (written) agreement or it is allowed under a relevant award, registered agreement, piece of legislation or court order; however, “cash back” schemes (whereby cash is paid back to an employer) are never allowed.

Special rules: Special rules to the national minimum wage in Australia apply to the following groups: junior employees, employees with a disability on a supported wage, and trainees or apprentices.

Junior employees are those under 21 years of age. Generally, junior employees receive a percentage of the relevant adult pay rate, unless they have completed an apprenticeship and have become qualified to perform a trade, or unless any applicable award, enterprise agreement, or registered agreement doesn’t include a junior rate. In the latter case, the percentage scale indicated in the Miscellaneous Award 2010 would be applied to the national minimum wage.

Apprentices and trainees are registered in formal training arrangements with their employer. Rates of pay for apprenticeships are determined by the length of the apprenticeship and how much training has been completed. They generally receive a percentage of the standard rate for the same type of employment. In most awards, the rates for full-time, part-time, and school-based trainees are found in the National Training Wage Schedule; however, it is important to note that employees cannot be designated as ‘trainees’ simply because they are starting a new position or learning a new task.

Although most disabled people participate in the Australian workforce according to full rates of pay, special rates apply to disabled employees where their disability affects their productivity. The Supported Wage System assists employees with a reduced work capacity. Eligibility for the SWS can only be determined by the Department of Social Services. Employers must apply to the Department of Social Services to see if an employee is eligible and to have the employee’s work capacity assessed by a qualified assessor. Based on this assessment, the disabled employee can receive a percentage of the relevant minimum rate. For example, an employee with an assessed work capacity of 80% will received 80% of the relevant pay rate. They will be paid a supported wage if they are covered by an award that contains Supported Wage System provisions. If they are covered by an award with no Supported Wage System provisions, the employee must be paid the full relevant pay rate. If they are not covered by an award, they will receive a percentage of the minimum wage based on their work capacity assessment.

UNITED STATES

Scope: In the United States, the federal government has laws governing minimum wage which fall under the Fair Labor Standards Act (FLSA) (1938).1 According to the FLSA, which sets this wage, the minimum wage must be paid to “employees who in any workweek [are] engaged in commerce or in the production of goods for commerce, or [are] employed in an enterprise engaged in commerce or in the production of goods for commerce.”

Coverage by the Act therefore applies in two distinct ways: to workplaces (or enterprises); and to individuals. An ‘enterprise’ for the sake of the Act, is a business or organization that has at least two employees and does at least $500,000 worth of business in a year, or is a hospital, site of medical care, school, or government agency. Anyone working for organizations meeting these criteria are covered by the FLSA. However, it is important to note that not all workplaces satisfy the Act’s requirements.

Some individuals are covered by the FLSA, despite their enterprise not being covered. Individuals who are engaged in commerce (as described in the language above) are covered. Individuals engaged in interstate commerce are also covered by the FLSA minimum wage provisions. The Act also states that agricultural employees are entitled to the minimum wage.

The FLSA applies to employees regardless of their immigration status; that is, undocumented employees are as entitled as any other worker to the minimum wage. This was determined by a federal district court in 2012 in the case Solis v. Cindy’s Total Care, Inc.

While the federal laws on minimum wage apply across the United States, many states have their own minimum wage laws. Currently, 29 states, plus the District of Columbia, have minimum wage laws on the books that exceed the rate of $7.25 per hour that is stipulated by the Fair Labor Standards Act. Two states (Georgia and Wyoming) have minimum wages legislated that are below the federal minimum wage, and five states have no minimum wage laws. In cases where state and federal laws exist, employees are entitled to a minimum wage equal to the higher of the two amounts stipulated. Thus in Georgia and Wyoming, the minimum wage laws are largely irrelevant, except in cases where employees are exempt by the FLSA but covered by state legislation.

Basic Standard: As of July 2023 the federal minimum wage is $7.25 hourly. This has been the minimum wage since July 25, 2009.

Special Situations

Deductions: According to section 3(m) of the FLSA, there are some circumstances in which employers may decrease the cash wage paid to an employee to below the minimum wage. These are referred to as section 3(m) credits. If, for example, the employer provides room and board to an employee (and the employee accepts it willingly), the employer is permitted to deduct those costs from the cash wages paid to the employee, provided that the total value of wages and room and board provided are not less than the hourly minimum wage.

Employees who regularly earn more than $30 per month in tips are also eligible to be paid less than the standard minimum wage. The amount deducted from the minimum wage must not be more than the employee actually makes in tips; that is, the total value of tips plus wages must be at least the value of the current minimum wage. There is a floor for the cash minimum wage paid to tipped employees: employers may deduct a maximum of $5.12 hourly. Thus, some employees who are regularly tipped are legally paid a wage of only $2.13 per hour. For employers who violate this law, for instance by deducting the full $5.12 per hour when the worker’s tips do not normally reach this value, penalties are generally monetary.

Exemptions: There are some exemptions from minimum wage protections under the FLSA; certain employees are not entitled to the minimum wage, including:

- Individuals employed in an executive, administrative, or professional capacity, including teachers

- Most employees in amusement or recreation establishments, organized camps, or religious or non-profit educational conference centres

- Most employees employed in the catching or farming of fish or other aquatic life

- Some agricultural employees

- Employees of small daily or weekly newspapers

- Switchboard operators for small telephone companies

- Employees on sea vessels not owned by the American government

- Babysitters and visitors to the infirm or aged

- Some criminal investigators

Special Rules: Not all employees are entitled to the regular minimum wage; specifically, new employees under 20 years of age are only entitled to a minimum wage of $4.25 per hour during their first 90 calendar days of employment. There are some important regulations that are associated with this special rule. First, regardless of how long their employment has lasted, as soon as the employee is 20 years of age, they must be paid the standard minimum wage rather than the youth minimum wage. Second, it is illegal for employers to ‘displace’ older employees in order to replace them with young employees paid at the youth minimum wage. Similarly, employers are not permitted under the law to hire only employees under 20 years of age and terminate them after the 90 day period in which they are eligible to be paid the youth minimum wage. The penalties for such violations are monetary.

“Handicapped employees” are also subject to a special rule. The Secretary of the Department of Labor can issue certificates that allow persons with disabilities to be paid a “subminimum” wage lower than the standard minimum wage. This is intended to “prevent the curtailment of opportunities for employment” for these individuals. An employer cannot pay a person with a disability below the minimum wage without prior authorization by the Department.

Table 5: US Minimum Wage Rates under the Fair Labor Standards Act, as of 2023

| Standard minimum wage | $7.25 per hour |

| New employees under 20 years during first 90 days of employment | $4.25 per hour |

| Tipped employees | $2.13 per hour |

CALIFORNIA

Scope: California’s minimum wage laws apply to nearly all employees, with some exemptions applying to outside salesperons, parents, spouses or children of employers, and apprentices.

Basic Standard: As of January 1, 2023 the minimum wage in California is $15.50 per hour. This is established in the California Labor Code, division 2 (“Employment Regulation and Supervision”), part 4 (“Employees”), chapter 1 (“Wages, Hours and Working Conditions”) (State of California, “California Labor Code”).

Special Situations

Deductions: In cases where an employer is providing either room, board, or both, the employer is entitled to reduce the minimum wage paid to the employee, if the employee voluntarily signs a written agreement to that effect. The amount deducted from an employee’s wage depends on the size of the organization employing them. Normally, organizations with 26 or more employees are allowed to deduct slightly more than organizations with 25 or fewer employees. More information pertaining to allowable deductions from the minimum wage, including meals and lodging, can be found on the State of California’s Department of Industrial Relations website.

Exemptions: According to the State of California Department of Industrial Relations, the standard minimum wage “shall not apply to outside salespersons and individuals who are the parent, spouse, or children of the employer.”

Special Rules: There are several special rules governing minimum wage laws in California. One of these applies to “learners”. Learners are individuals who have no previous similar or related experience to the job for which they are now being paid. Learners can be of any age, and are entitled to a minimum wage that is 85 percent of the standard California minimum wage (rounded to the nearest nickel) for their first 160 hours of employment.

Another special rule regards employees who are “mentally or physically handicapped”. Employees with such disabilities, or non-profit organizations who regularly employ them, can be granted a license by the Division of Labor Standards authorizing a wage below the standard minimum. The licenses for individuals and non-profits must be renewed on an annual basis.

ILLINOIS

Scope: Illinois’ minimum wage laws cover all workers in the state, although employers may pay new employees (during the first 90 days of employment) up to 50 percent less and tipped employees up to 60 percent less than the standard minimum wage. Additionally, some local jurisdictions within the State of Illinois have set minimum wages higher than the Illinois rate, including Cook County and the City of Chicago.

Basic Standard: The standard minimum wage in Illinois is $13 per hour as of January 1, 2023. According to state legislation, any wage below this is considered “an unreasonable and oppressive wage, and less than sufficient to meet the minimum cost of living necessary for health.” However, a February 2019 bill signed by the Governor of Illinois sets out a schedule for minimum wage increases over the coming years. By January 2025, Illinois will have a $15 per hour minimum wage. As of July 1, 2023 the City of Chicago’s minimum wage is $15.80 per hour for employees in workplaces with 21 or more workers ($15 per hour for workplaces with 20 or fewer workers) and Cook County’s minimum wage is $13.70 per hour.

If an employee has been underpaid, that is, paid less than the minimum wage for any hours worked, they have three years in which they may initiate civil action against their employer. Employers face financial penalties if they are found guilty of payment below the minimum wage.

Special Situations

Exemptions: There are several groups of employees who are exempt from minimum wage laws by Illinois statute. “Outside salesmen” are not protected by minimum wage laws. This exemption applies to a worker “who regularly makes sales or obtains orders or contracts for services and who performs a major portion of these duties away from the employer’s place of business.” Illinois law also exempts “computer systems analysts, computer programmers, software engineers, or other similarly skilled employees” from minimum wage coverage.

If an employer has fewer than four employees, those employees are not entitled to the minimum wage. Nor are individuals providing domestic services in a private home, individuals working for a religious organization, students working at an accredited Illinois college or university, or “individuals working for motor carriers subject to regulation by the US Secretary of Transportation regarding employee classifications and maximum hours of service.”

Furthermore, individuals employed in agriculture and aquaculture are exempt from minimum wage coverage if they fall into one of the following categories:

- they work for an employer who, during the any quarter of the previous calendar year, did not use more than 500 man-days of labour;

- they are the immediate family member of the employer;

- they are over 16 years of age, are paid a wage based on piece-rate, travel to work daily from a permanent residence, and did this work for fewer than 13 weeks in the previous calendar year; or

- they are under 16 years of age, are paid a piece-rate, are employed on the same farm as their parent or guardian, and are paid an equal wage to other 16 year-olds on the farm

Special Rules: There are special rules that apply to certain groups. For instance, tipped employees must be paid the minimum wage, but employers may “take credit” for an employee’s tips in an amount that does not exceed 40% of their wages. Employers may also pay a lower “training wage” to tipped employees during the first 90 days of employment. Employees over the age of 18, who do not receive tips, may be paid $12.50 for the first 90 days with their employer.

Employers taking advantage of the tip credit are required to keep accurate records of tips earned by employees in order to ensure that the sum of the reduced minimum wage and actual tips earned is not below the standard minimum wage.

Employers are also permitted to pay employees with disabilities a reduced minimum wage, provided that they receive a license from the Department of Labor. The legislation states that this is allowed, “in order to prevent the curtailment of opportunities for employment, avoid undue hardship, and safeguard the minimum wage rate under this act.” Furthermore, the law states that this is only permitted in cases where the worker’s disability actually affects their ability to perform their work. There is no standard minimum wage for individuals with disabilities; a rate is proposed by the employer and evaluated by the Department when the application for a license is submitted.

Similarly, “in order to prevent the curtailment of opportunities for employment”, employers may pay a subminimum wage to an employee who is learning how to do a job. Employees may only reduce the wages of these ‘learners’ if they have been granted a license to do so. The learner wage may be no less than 70% of the standard minimum wage, but the actual wage paid to a learner is determined during the employer’s license application process. Furthermore, a worker may only be paid the learner wage for a maximum of six months, after which they are no longer considered a learner.

Table 6: Minimum Wages in Illinois, as of July 2023

| Standard minimum wage for employees over age 18 | $13 per hour |

| Minimum wage for employees under age 18 | $10.50 per hour |

| Minimum wage during first 90 days with an employer | $12.50 per hour |

| Minimum wage for tipped employees | $7.80 per hour (with 40% tip credit) |

| Minimum wage for tipped employees during first 90 days with employer | $7.80 per hour (with 40% tip credit) |

| Minimum wage for ‘learners’ | 70% of applicable minimum wage |

NEW YORK

Scope: As of 2023, three separate minimum wage rates cover employees in New York: one for employees in New York City, one for employees in Long Island and Westchester County, and one covering the remainder of employees in New York State.

Basic Standard: As part of the 2016-17 State Budget, New York State established a schedule to raise the statewide minimum wage to $15 per hour by 2023. As of January 2023, the minimum wage covering employers in New York City and Long Island and Westchester had reached $15.00 per hour. For employers everywhere else in the state, the minimum wage will reach $15 per hour in 2024. Further increases to the minimum wage are scheduled annually.

Special Situations

Exemptions: There are a number of employees who are not covered by the Minimum Wage Act, such as employees who are employed:

- “on a casual basis in service as a part time baby sitter in the home of the employer;

- in labor on a farm;

- in a bona fide executive, administrative, or professional capacity;

- as an outside salesman;

- as a driver engaged in operating a taxicab;

- as a volunteer, learner or apprentice by a corporation, unincorporated association, community chest, fund or foundation organized and operated exclusively for religious, charitable or educational purposes, no part of the net earnings of which inures to the benefit of any private shareholder or individual;

- as a member of a religious order, or as a duly ordained, commissioned or licensed minister, priest or rabbi, or as a sexton, or as a christian science reader;

- in or for such a religious or charitable institution, which work is incidental to or in return for charitable aid conferred upon such individual and not under any express contract of hire;

- in or for such a religious, educational or charitable institution if such individual is a student;

- in or for such a religious, educational or charitable institution if the earning capacity of such individual is impaired by age or by physical or mental deficiency or injury;

- in or for a summer camp or conference of such a religious, educational or charitable institution for not more than three months annually;

- as a staff counselor in a children’s camp;

- in or for a college or university fraternity, sorority, student association or faculty association, no part of the net earnings of which inures to the benefit of any private shareholder or individual, and which is recognized by such college or university, if such individual is a student;

- by a federal, state or municipal government or political subdivision thereof;

- as a volunteer at a recreational or amusement event run by a business that operates such events, provided that no single such event lasts longer than eight consecutive days and no more than one such event concerning substantially the same subject matter occurs in any calendar year” (see Minimum Wage Act, 2018, s. 651.5).

Special Rules: Employers may pay less than the minimum wage in industries where employees are regularly tipped, other than the “building service industry.” This is because employers can claim ‘tip credits’, which enable a worker’s tips to count towards their minimum wage. The minimum wage for tipped employees depends on the industry in which they are employed and the region in which they work.

The minimum wage rates for service employees in the hospitality industry who receive tips, as of January 2023, are set out in Table 7.

Table 7: Minimum Wages in New York State, as of January 2023

| Standard minimum wage, NYC | $15.00 per hour |

| Standard minimum wage, Long Island & Westchester | $15.00 per hour |

| Standard minimum wage, elsewhere in New York State | $14.20 per hour |

| Tipped service employees in NYC | $12.50 per hour |

| Tipped food service employees in NYC | $10.00 per hour |

| Tipped service employees, Long Island and Westchester | $12.50 per hour |

| Tipped food service employees, Long Island and Westchester | $10.00 per hour |

| Tipped service employees, rest of NY State | $11.85 per hour |

| Tipped food service employees, rest of NY State | $9.45 per hour |

LOS ANGELES COUNTY

Scope: Los Angeles County, California is one of the geographically largest counties in the United States and has the largest population of any county in the country at nearly 10 million people. Over 80 cities are located in Los Angeles County, the largest being Los Angeles.

Basic Standard: Los Angeles County has its own minimum wage ordinances. The county ordinance that establishes the minimum wage cites poverty and inequality in the state of California as justification for providing an increased minimum wage in LA County. As of July 2023, the LA County minimum wage is $16.90 per hour. Up to 2021, LA County set two different minimum wage rates for large employers (with 26 or more employees) and small employers (with 25 or fewer employees). This practice was eliminated in 2021 when $15 per hour was established as a state-wide minimum.

Special Situations

Exemptions: The LA County minimum wage ordinance does not apply to individuals who are exempt from (or not subject to) the California Labour Code. Furthermore, anyone employed by public entities, including state, federal, and county organizations, as well as school districts, are not covered by the minimum wage ordinance.

LOS ANGELES

Scope: The city of Los Angeles, California has its own minimum wage ordinance. According to the city, “Los Angeles is a low-wage city with a high cost of living.” The purpose of the municipal minimum wage is to increase the minimum wage to be more in line with the cost of living. Moreover, it is noted in the ordinance that people of colour are disproportionately low-wage employees, and thus this law has an important role in creating a more equitable labour market. The ordinance also notes high rates of child poverty in Los Angeles and seeks to remedy it.

Basic Standard: The minimum wage, as of July 1, 2023, in Los Angeles is just below that of Los Angeles County, $16.78 per hour.

Special Situations

Special Rules: Similarly to the California minimum wage rules, employees who are ‘learners’ have an amended minimum wage during their first 160 hours of employment. However, in the Los Angeles ordinance, the special rule for learners only applies to employees 14 to 17 years of age. During the ‘learner’ period, these employees are entitled to only 85% of the standard minimum wage.

Table 8: Minimum Wages in Los Angeles, as of July 2023

| Standard minimum wage | $16.78 per hour |

| Learners, age 14 to 17 | 85% of applicable minimum wage |

CHICAGO

Scope: The city of Chicago, Illinois has its own municipal minimum wage ordinance. Citing inadequate federal and state minimum wages in a city with a high cost of living, the city council of Chicago established a higher minimum wage within its boundaries.

Basic Standard: As of July 1, 2023, the standard minimum wage in Chicago is $15.80 per hour for large employers (21 or more employees) and $15 per hour for small employers (20 or fewer employees). Youth workers may be paid a sub-minimum wage of $13.50 per hour. Tipped workers in large and small workplaces also have special minimum wage rates of $9.48 per hour and $9 per hour, respectively. Tipped youth can be paid $8.10 per hour. Starting in 2019, Chicago minimum wage rates are adjusted according to inflation as measured by the consumer price index.

Special Situations

Exemptions: Chicago’s minimum wage does not apply to individuals who are normally exempt from Illinois’ minimum wage laws. However, while automobile and farm equipment salespeople, as well as boat, aircraft, and trailer salespeople are exempt from the state laws, they are covered by Chicago’s ordinance. Moreover, employees of government institutions other than City of Chicago institutions are not covered by the ordinance. Finally, employees in a “Subsidized Temporary Youth Employment Program” or a “Subsidized Transitional Employment Program” are also not covered by Chicago’s minimum wage.

Special Rules: As noted above, there are separate minimum wage rates for tipped employees in Chicago. In practice, this means that employers of tipped employees in the city of Chicago earn a “tip credit” toward the cost of employee wages.

Table 9: Minimum Wages in Chicago, as of July 1, 2023

| Standard minimum wage (large employers, 21 or more employees) | $15.80 per hour |

| Standard minimum wage (small employers, 20 or fewer employees) | $15 per hour |

| Youth minimum wage | $13.50 per hour |

| Minimum wage for tipped employees (large employers, 21 or more employees) | $9.48 per hour |

| Minimum wage for tipped employees (small employers, 20 or fewer employees) | $9 per hour |

| Youth minimum wage for tipped employees | $8.10 per hour |

PUBLIC HOLIDAY PAY

CANADA

Basic Standard: Employees in Canada’s federal jurisdiction are entitled to 10 general public holidays with pay each year: New Year’s Day, Good Friday, Victoria Day, Canada Day, Labour Day, National Day for Truth and Reconciliation, Thanksgiving Day, Remembrance Day, Christmas Day, and Boxing Day.

General holiday pay is equal to at least one twentieth of the wages, excluding overtime pay, that an employee earned in the four-week period immediately preceding the week in which the general holiday occurs. Different calculation methods apply in the long-shoring industry, for employees on commission, in continuous operation businesses, and for managerial and professional employees.

As of September 1, 2019 employees are entitled to holiday pay from the start of employment, eliminating the previous 30 day employment eligibility requirement.

Special Situations

Employees on Commission: An employee whose wages are paid in whole or in part on a commission basis and who has completed at least 12 weeks of continuous employment with an employer is entitled to holiday pay equal to at least one sixtieth of the wages, excluding overtime pay, that they earned in the 12-week period immediately preceding the week in which the general holiday occurs.

Continuous Operation Employees: If a continuous operations employee does not report to work on a public holiday on which they are scheduled to work, the employer is not required to pay the employee for that general holiday. Likewise, if an employee is unavailable to work on a general holiday, the employer does not have to pay the employee for the general holiday.

Additional Pay for Holiday Work: An employee who is required to work on a day on which they are entitled to holiday pay is entitled, in addition to the holiday pay for that day, wages at a rate equal to at least one and one-half times their regular rate of wages for the time that they work on that day.

ONTARIO

Basic Standard: Ontario has 9 public holidays: New Year’s Day, Family Day, Good Friday, Victoria Day, Canada Day, Labour Day, Thanksgiving Day, Christmas Day, and Boxing Day. Most employees who qualify are entitled to take these days off work and be paid public holiday pay. Alternatively, the employee can agree in writing to work on the holiday and be paid:

- public holiday pay plus premium pay for all hours worked on the public holiday and not receive another day off (called a “substitute” holiday); or

- be paid their regular wages for all hours worked on the public holiday and receive another substitute holiday for which they must be paid public holiday pay.

Employees are entitled to public holidays and to public holiday pay whether they are full-time, part-time, permanent, or on term contract. It does not matter how recently they were hired, or how many days they worked before the public holiday. Most employees who fail to qualify for the public holiday entitlement are still entitled to be paid premium pay for every hour they work on the holiday.

The amount of public holiday pay to which an employee is entitled is all of the regular wages (excluding overtime or premium pay) earned by the employee in the four work weeks before the work week with the public holiday plus all of the vacation pay payable to the employee with respect to the four work weeks before the work week with the public holiday, divided by 20. Additionally, the ESA sets out detailed information on how to calculate public holiday pay if the holiday falls during an employee’s vacation, or if an employee fails to work on their last scheduled day before the public holiday or after it, or when an employee works on a public holiday and a substitute holiday is given, and similar scenarios.

Special Situations

Exemptions: While most employees are eligible for the public holiday entitlement, some employees work in jobs that are not covered by the public holiday provisions of the ESA. For example, construction employees of various kinds are not entitled to public holidays or public holiday pay if they receive 7.7% or more of their hourly wages for vacation or holiday pay.

Requirement to Work: Hospital employees, continuous operation employees, and employees in the hospitality industry may be required to work on public holiday if the day on which the holiday falls is normally a working day for the employee and the employee is not on vacation on that day. If an employee is required to work on a public holiday, the employer may either pay the employee their regular rate for the hours worked on the public holiday, and provide a substitute day off work with public holiday pay or pay the employee public holiday pay plus premium pay for each hour worked on the public holiday.

UNITED KINGDOM

Basic Standard: Public holidays in the UK are referred to as bank holidays. The specific holidays differ somewhat between England and Wales, Scotland, and Northern Ireland. Employees do not have a legal right to paid leave on bank holidays. Any right to paid time off on bank holidays will be indicated in the employment contract and it will count towards an employee’s statutory annual leave. If the place of employment is closed on a bank holiday, the employer has the right to decide if the employe must take the day off as part of their annual paid vacation entitlement.

AUSTRALIA

Basic Standard: Australia has 8 national public holidays: New Year’s Day, Australia Day, Good Friday, Easter Monday, Anzac Day, Christmas Day, and Boxing Day. State and territory governments may also separately declare additional public holidays such as the Queen’s Birthday and Labour Day.

All employees in Australia’s national workplace relations system are covered by the National Employment Standards, which outlines the above mentioned public holidays, including those declared by state or territory governments.

According to Australia’s National Employment Standards, most employees are entitled to take a paid day (or part day) off work on public holidays. Full- and part-time employees who would normally work on a public holiday are entitled to be paid their base rate of pay, for their ordinary hours of work, and take the day off. If an employee does not have ordinary hours of work on the public holiday (for instance, if they are a casual or part-time employee and their part-time hours would not have included the day of the week on which the holiday falls) then they are not entitled to payment for the public holiday (see Fair Work Act, 2009, s.116). Casual employees are entitled to take an unpaid day off work on public holidays. Employees who are off work on their annual vacation leave or due to sick leave are still entitled to a public holiday (see Fair Work Act, 2009, s. 114).

Special Situations

Requirement to Work: Employers may request that an employee work on a public holiday, on the condition that the request is reasonable; the Fair Work Act (2009, s. 114) outlines the factors used to determine what constitutes a reasonable request. Employees may also refuse a request to work on a public holiday if their refusal is reasonable. Employees covered by an award or enterprise agreement who work on a public holiday may also be entitled to additional pay (this is called a penalty rate), an extra day of annual vacation leave, or a substitute paid day off work (see Fair Work Act, 2009, s. 116).

UNITED STATES

The Federal Labour Standards Act (FLSA) does not require that employers pay employees for time that they have not worked. This includes public holidays. Employers may offer paid public holidays, but they are under no obligation to do so. Moreover, employers have no legal obligation to pay their employees anything above their standard rate of pay if they work on a public holiday.

CALIFORNIA

California law does not require that employers pay employees for time that they have not worked, including public holidays. Furthermore, there is nothing preventing employers from requiring employees to work on public holidays, and they are under no obligation to pay anything above the usual rate of pay on those occasions.

ILLINOIS

Employers in Illinois are not required by state law to pay employees for time that they have not worked, including public holidays. They are also not required to pay anything above the standard rate of pay for work performed on public holidays.

NEW YORK

The New York State Labor Law does not require payment for time not worked, including public holidays. Employers are not prevented from requiring work on public holidays, and are not required to provide premium pay.

ANNUAL VACATION LEAVE PAY

CANADA

Basic Standard: An employee with fewer than five years of employment is entitled to at least two weeks of vacation annually with vacation pay of at least 4% of gross wages. Employees with 5 or more years of employment are entitled to at least three weeks of vacation annually with vacation pay of at least 6% of gross wages. As of September 1, 2019, employees with 10 or more years of employment are entitled to at least four weeks of vacation annually with vacation pay of at least 8% of gross wages. Employers are required to pay employees accumulated annual vacation pay when the employee takes vacation. Any outstanding vacation pay must also be paid to an employee within 30 days upon termination of their employment.

ONTARIO

Basic Standard: An employee is entitled to at least two weeks of vacation annually with vacation pay of at least 4% of gross wages. After six consecutive years of employment with one employer, an employee is entitled to three weeks of vacation with pay equivalent to at least 6% of gross wages.

Vacation must be granted no later than 10 months after completion of the year entitling the employee to the vacation. Employers are required to pay employees accumulated annual vacation pay when the employee takes vacation. Any outstanding vacation pay must also be paid to an employee within 30 days upon termination of their employment.

An employee who does not complete either the full vacation entitlement year or the stub period (if any) does not qualify for vacation time under the ESA. However, employees earn vacation pay as they earn wages. So if an employee works even just one hour, he or she is still entitled to at least four percent of the hour’s wages as vacation pay. The gross “wages” on which vacation pay is calculated include: regular earnings, including commissions; bonuses and gifts that are non-discretionary or are related to hours of work; overtime pay; public holiday pay; termination pay; and allowances for room and board.

Gross wages do not include: vacation pay paid out or earned but not yet paid; tips and gratuities; discretionary bonuses and gifts that are not related to hours of work, production, or efficiency (e.g., a Christmas bonus unrelated to performance); expenses and traveling allowances; living allowances; contributions made by an employer to a benefit plan and payments from a benefit plan (e.g., sick pay) to which an employee is entitled; federal employment insurance benefits; and severance pay.

Special Situations

Exemptions: In Ontario, farm employees and fishers are exempt from the vacation with pay provisions of the ESA.

Special Rules: In Ontario, a special rule applies to vacation pay for harvester employees whereby they are entitled to a vacation with pay if they have been employed by the same employer for 13 weeks or more. The 13 weeks do not have to be consecutive.

UNITED KINGDOM

Basic Standard: Annual vacation rules in the UK apply to those designated as ‘workers’ or ‘employees’ under section 230 of the Employment Rights Act 1996. Generally, the term worker is a broader designation: it is greater in scope than the term employee and holds fewer rights. Under Working Times Regulations 1998 (amended), most workers and employees in the UK are entitled to a statutory annual leave (also known as statutory leave entitlement) of 5.6 weeks off each year. This includes those working full and part-time, agency workers, and casual workers, on a pro-rata basis. Employers may choose to offer additional leave beyond the minimum, but the rules that apply to the statutory annual leave do not necessarily apply to any additional leave. For instance, additional leave may be conditional on having worked for an organization for a certain length of time.

The number of paid days of annual leave is calculated based on the number of days a week an employee would normally work. For instance, for an employee that normally works five days a week multiply this number (five) by the annual entitlement of 5.6 weeks to receive 28 paid days off. Likewise, an employee that works two days a week is entitled to 11.2 paid days off. It is important to note, however, that statutory annual leave is limited to 28 paid days off, regardless of whether or not an employee normally works more than five days per week.

Employers have the right to designate times when statutory leave must be taken, for instance, to close an office on a bank (public) holiday. If an employee or worker is entitled to paid time off on a bank holiday, this will count towards their statutory annual leave, unless indicated otherwise in their employment contract.

Employees and workers do not necessarily have a right to carry over any unused leave into the next year; however, an employer may agree to carry-overs in their employment contract. In either circumstance, employees and workers must take a minimum of four weeks of statutory leave within a given year. If an employee or worker is entitled to more than four weeks of holiday, then they may carry the additional leave into the following year provided that their employer agrees to it. Those who are off work due to sick leave, maternity, paternity or adoption leave may accrue their annual leave and roll it into the following year, or they may be paid for this leave. Employees may also request to take a holiday while on sick leave.

The amount of holiday pay an employee receives while on annual leave is calculated as follows:

Table 10: Calculating Holiday Pay in the United Kingdom

| Type of work | Holiday Pay |

| Fixed working hours (full-time or part-time ) | One week of holiday pay is equivalent to pay received for a normal week’s work. |

| Shift work with fixed hours (full or part-time) | One week of holiday pay is equivalent to the average number of weekly hours worked over the previous 12 weeks at their average hourly rate. |

| Casual work with no fixed hours | One week of holiday pay is equivalent to the average pay received over the last 12 (paid) weeks of work. |

Holiday pay calculations need to factor in the following: guaranteed and non-guaranteed overtime, commission, and work-related travel. Holiday pay is to be paid out when a worker takes their annual leave. Rolled up holiday pay is not permitted, meaning that an employer cannot choose instead to include a worker’s holiday pay in with their hourly rate. Employees may only be paid in lieu of statutory annual leave when their employment ends.

Employers should inform all staff of the dates of the statutory leave year (i.e., if it runs from January 1 to December 31, or otherwise) and employees must take their leave during that year. If employers have not indicated the statutory leave year in an employee’s contract, the following rules apply: if an employee started working for that employer on or before October 1, 1998, their statutory leave year begins on October 1. If an employee was hired after October 1, 1998, their statutory leave year begins on the first date of their job. If an employee is hired mid-way through a leave year, they are only entitled to a portion of their annual leave in that year, depending on how much of the leave year remains.

The amount of notice required for requesting annual leave is generally twice as long as the amount of leave days requested. For example, if an employee is requesting one day of leave they must provide a minimum of two days’ notice. Employers may decline an employee’s leave request but they must provide the employee with as much notice as was requested off (i.e., 3 weeks of notice for three weeks of leave).

AUSTRALIA